41 price of coupon bond

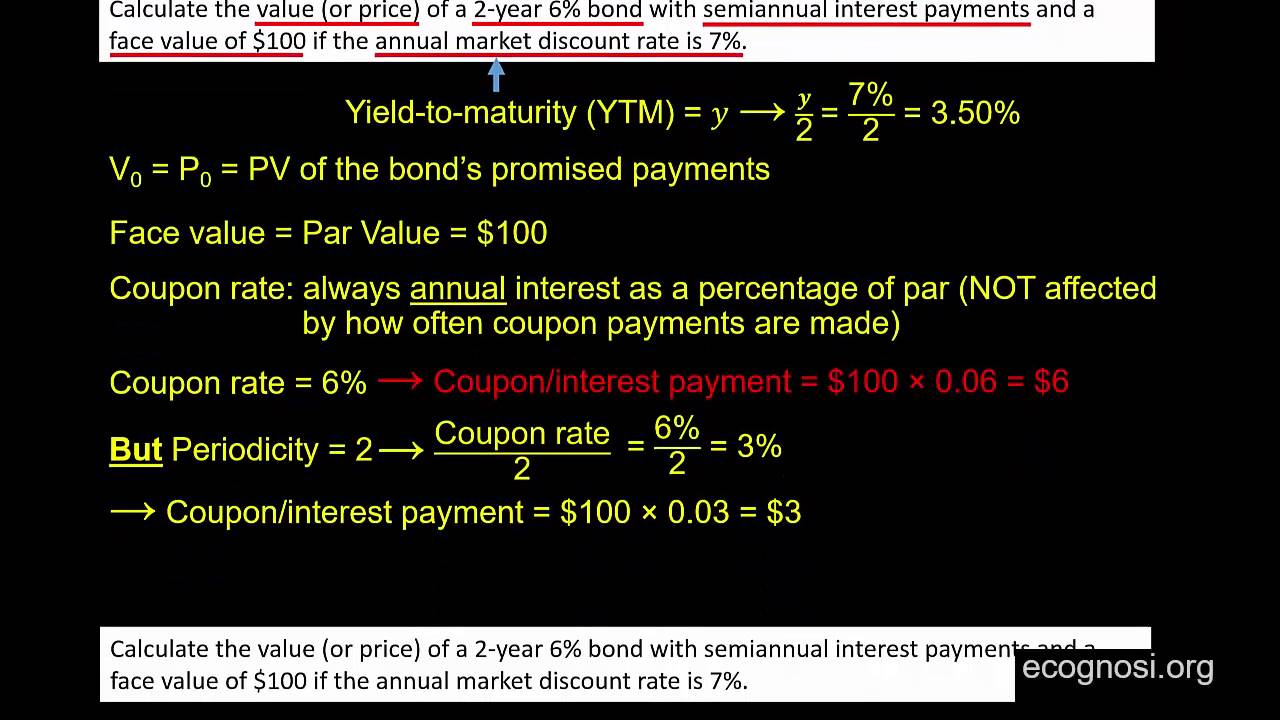

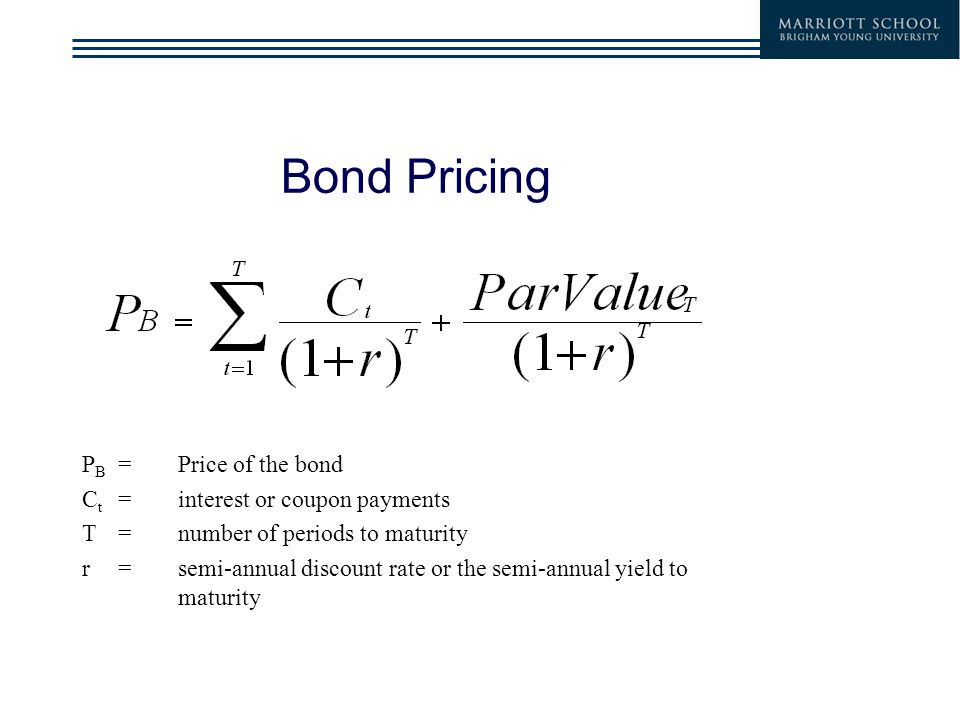

budgeting.thenest.com › calculate-price-bondHow to Calculate the Price of a Bond With Semiannual Coupon ... Apr 24, 2019 · Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to achieve an equivalent return. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment. › coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

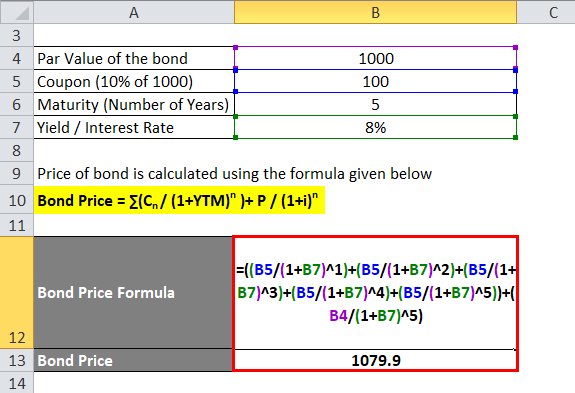

› documents › excelHow to calculate bond price in Excel? - ExtendOffice Let’s say there is a annul coupon bond, by which bondholders can get a coupon every year as below screenshot shown. You can calculate the price of this annual coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key. See screenshot:

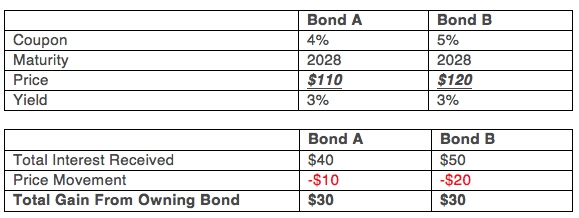

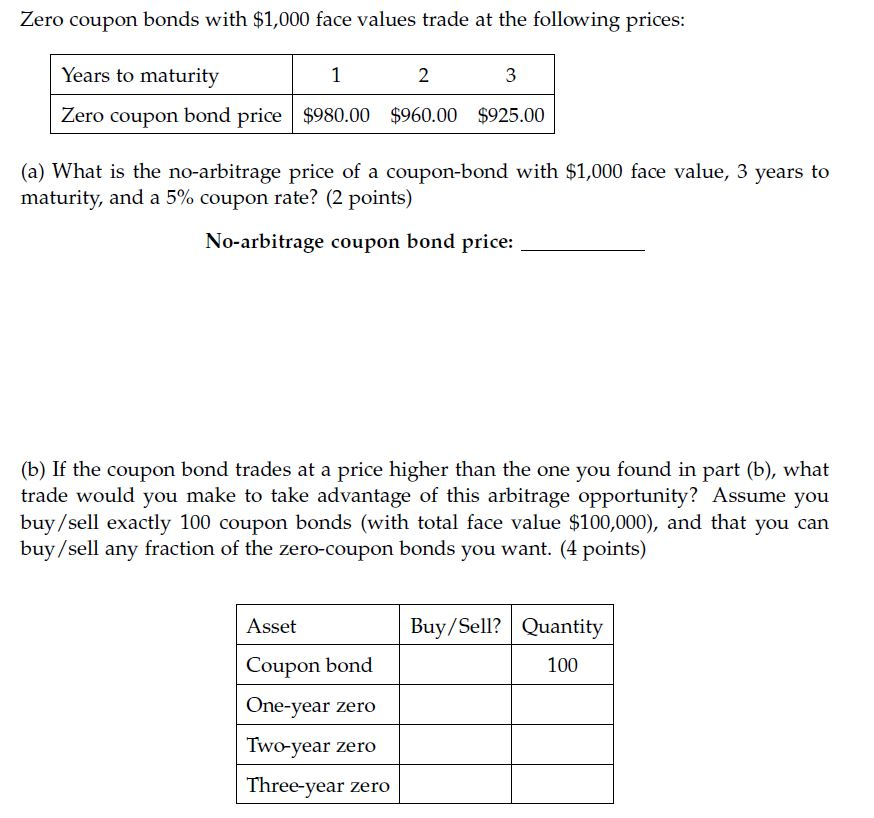

Price of coupon bond

› finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life. You can see how it changes over time in the bond price chart in our calculator. dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ... en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The terms of the bond, such as the coupon, are fixed in advance and the price is determined by the market. In the case of an underwritten bond, the underwriters will charge a fee for underwriting. An alternative process for bond issuance, which is commonly used for smaller issues and avoids this cost, is the private placement bond.

Price of coupon bond. › terms › cClean Price Definition - Investopedia Mar 31, 2020 · Clean price is the price of a coupon bond not including any accrued interest . A clean price is the discounted future cash flows , not including any interest accruing on the next coupon payment ... en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The terms of the bond, such as the coupon, are fixed in advance and the price is determined by the market. In the case of an underwritten bond, the underwriters will charge a fee for underwriting. An alternative process for bond issuance, which is commonly used for smaller issues and avoids this cost, is the private placement bond. dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ... › finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life. You can see how it changes over time in the bond price chart in our calculator.

Post a Comment for "41 price of coupon bond"