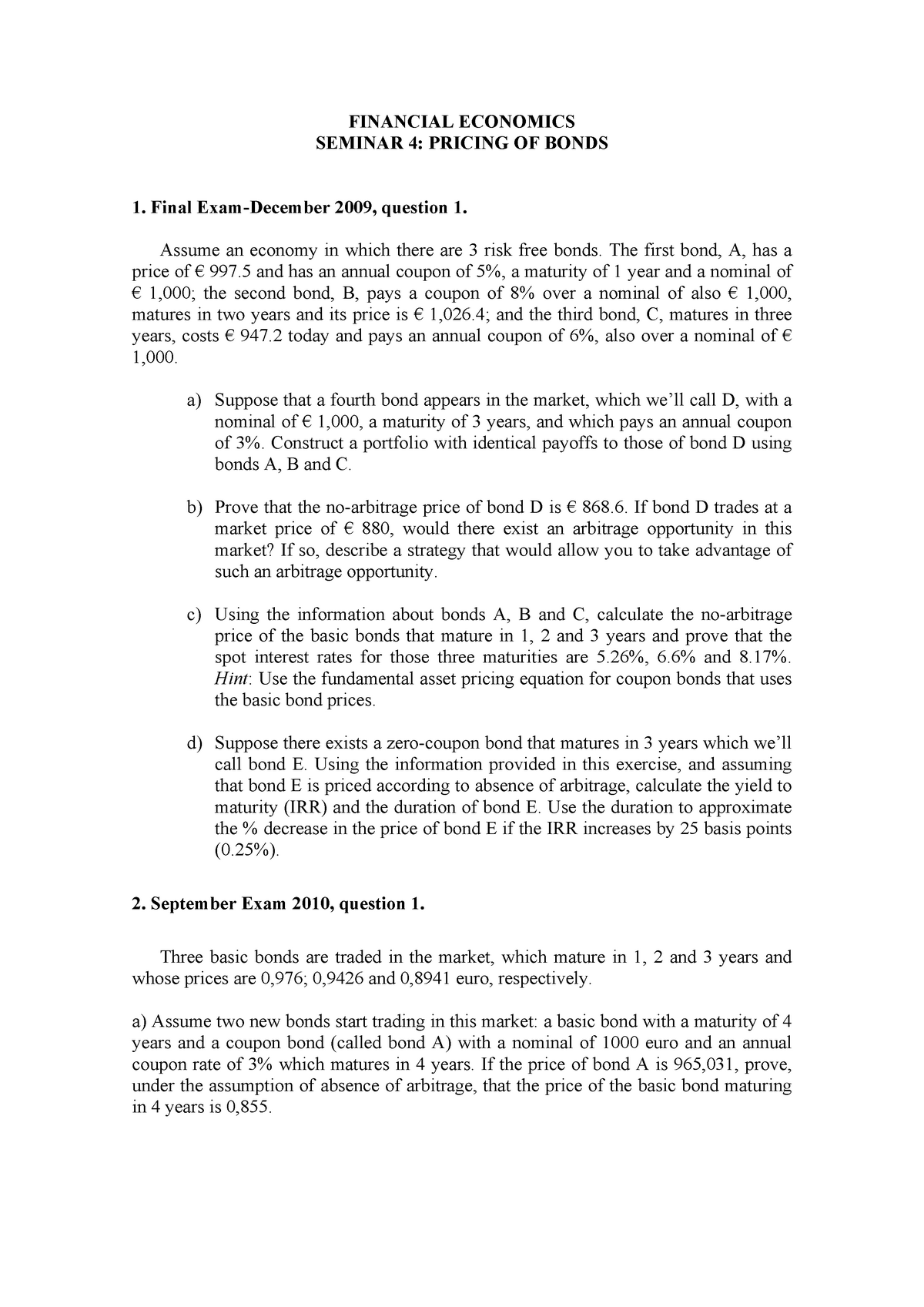

39 advantage of zero coupon bond

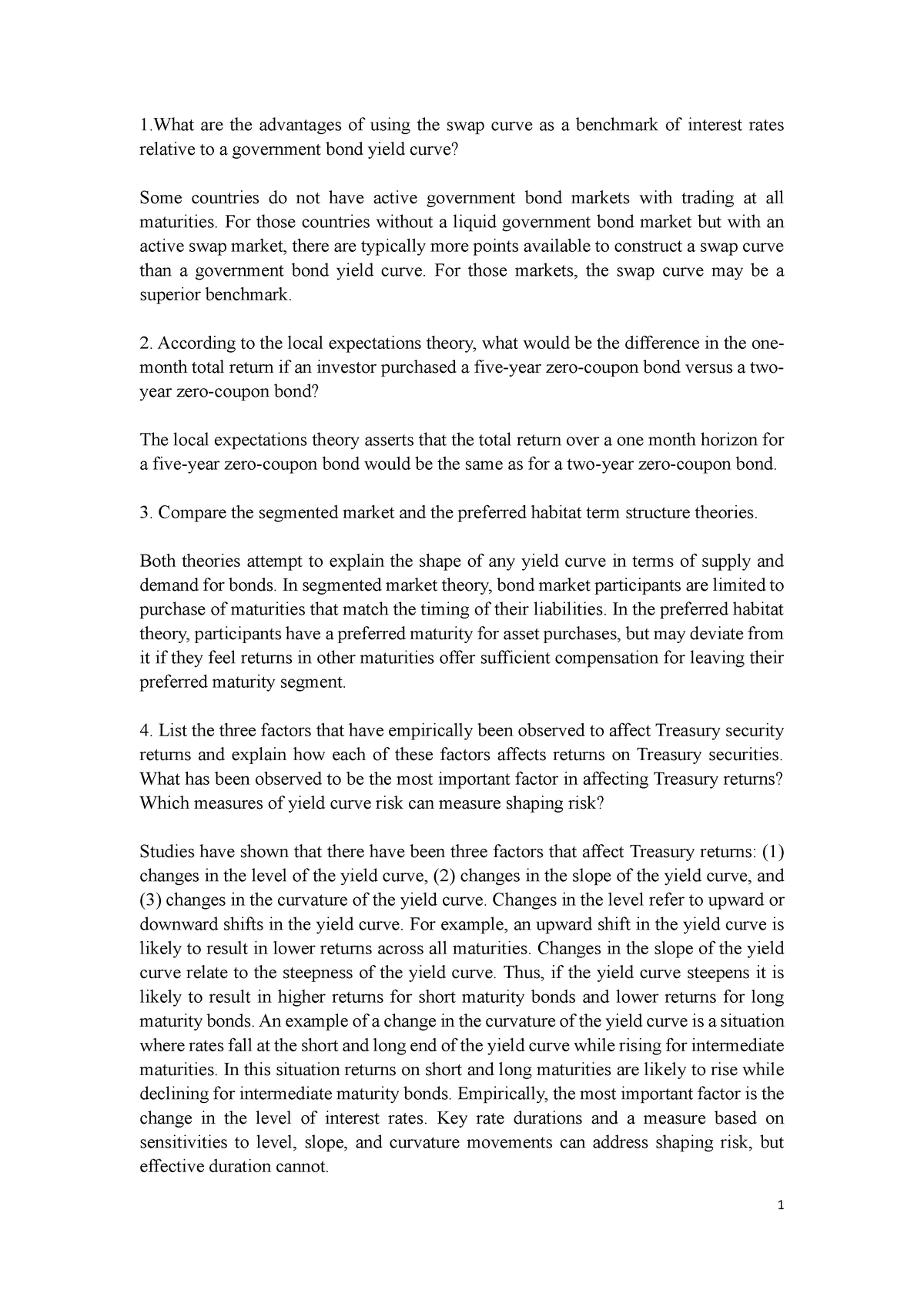

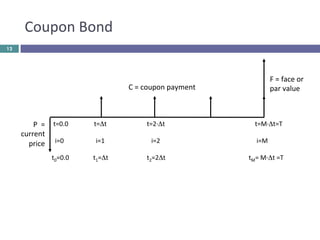

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · However, that significant advantage also comes with several unique risks. KEY TAKEAWAYS. ... If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used ... smartasset.com › investing › face-value-of-a-bondWhat Is the Face Value of a Bond? - SmartAsset Sep 21, 2022 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

Advantage of zero coupon bond

› etfs › arcxiShares iBoxx $ High Yield Corp Bd ETF HYG - Morningstar, Inc. May 04, 2022 · IShares iBoxx $ High Yield Corporate Bond ETF HYG is an affordable option for exposure to U.S. high-yield corporate bonds. But the inherent illiquidity in this market limits its breadth and ... › terms › pPerpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... › fixed-income-bonds › individualUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ...

Advantage of zero coupon bond. en.wikipedia.org › wiki › Convertible_bondConvertible bond - Wikipedia Coupon: Periodic interest payment paid to the convertible bond holder from the issuer. Could be fixed or variable or equal to zero. Maturity/redemption date: The date on which the principal (par value) of the bond (and all remaining interest) are due to be paid. In some cases, for non-vanilla convertible bonds, there is no maturity date (i.e ... What is Zero Coupon Bond? - Groww › fixed-income-bonds › individualUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ... › terms › pPerpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

› etfs › arcxiShares iBoxx $ High Yield Corp Bd ETF HYG - Morningstar, Inc. May 04, 2022 · IShares iBoxx $ High Yield Corporate Bond ETF HYG is an affordable option for exposure to U.S. high-yield corporate bonds. But the inherent illiquidity in this market limits its breadth and ...

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "39 advantage of zero coupon bond"