45 current yield coupon rate

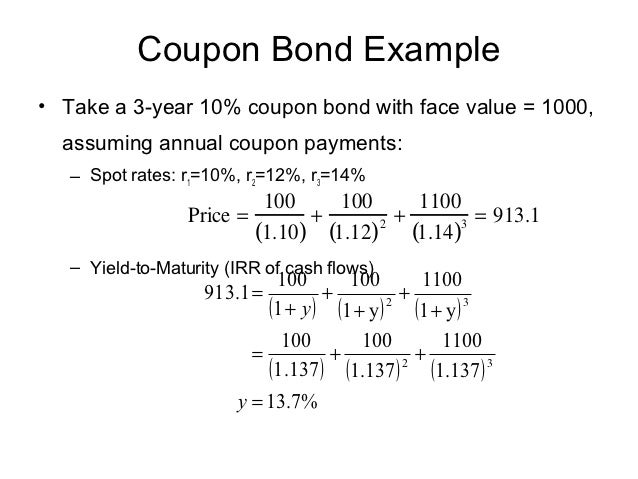

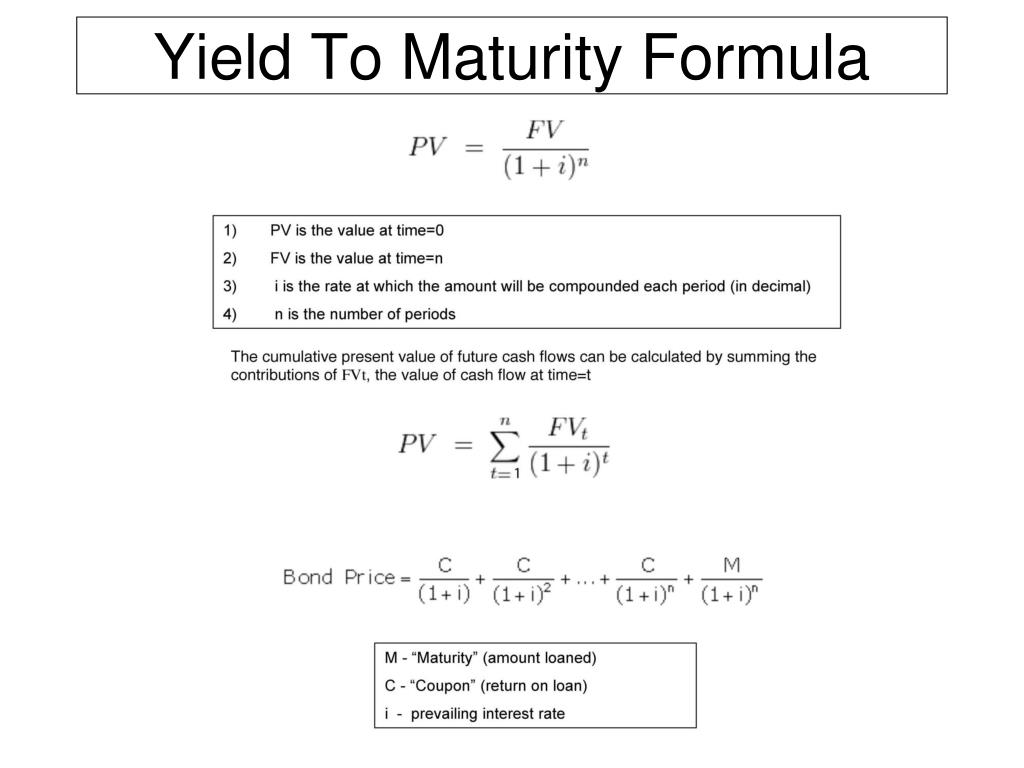

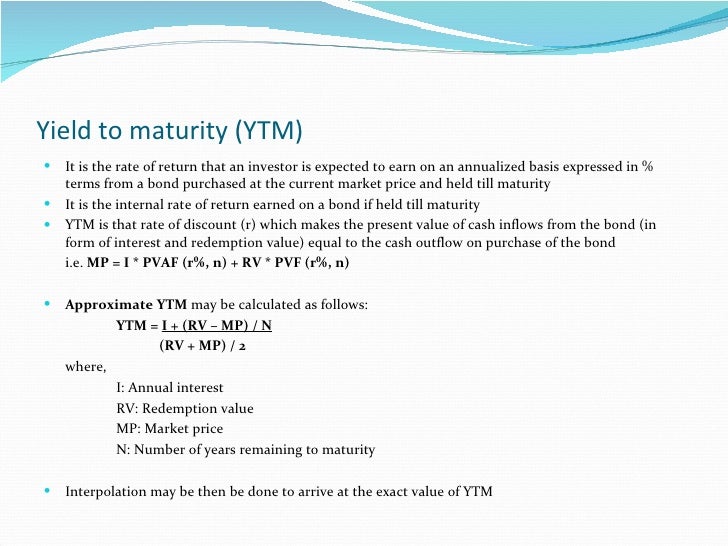

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Current Yield vs. Yield to Maturity: What's the Difference? In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount. While the current yield of one bond may be more attractive, the yield to maturity of another could be substantially higher.

Current yield coupon rate

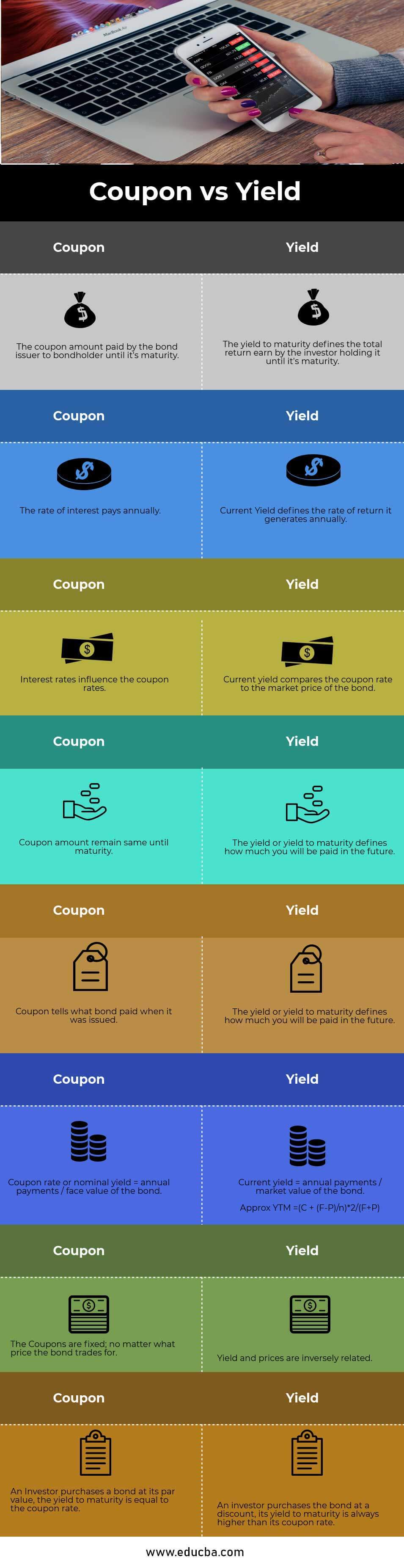

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Later, the bond's face value drops down to $900; then its current yield rises to 7.8% ($70 / $900). Usually, the coupon rate does not change, it is a function of the annual payments, and the face value and both are constant. Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Difference Between Coupon Rate and Yield of Maturity The current yield compares the coupon rate to the market price of the bond. 4; The coupon amount remains the same till its maturity. The market price keeps on changing so it's better to purchase a bond at a discount which represents a larger share of the purchase price. 5; Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link.

Current yield coupon rate. United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Current Yield Formula (with Calculator) - finance formulas The formula for current yield only looks at the current price and one year coupons. Example of the Current Yield Formula. An example of the current yield formula would be a bond that was issued at $1,000 that has an aggregate annual coupon of $100. The bond yield on this particular bond would be 10%. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... Current Yield | Formula, Example, Analysis, Calculator The current yield focuses more on its actual value now than on its value in the future. Current Yield Example Maria purchased a bond for $18,000. The bond has an annual coupon rate of 7%. This means her coupon amount would be $1260 per year. The market price of the bond is $14,500. What would the current yield be based on this market rate? What Are Coupon and Current Bond Yield All About? - dummies The coupon yield, or the coupon rate, is part of the bond offering. A $1,000 bond with a coupon yield of 5 percent is going to pay $50 a year. A $1,000 bond with a coupon yield of 7 percent is going to pay $70 a year. Usually, the $50 or $70 or whatever will be paid out twice a year on an individual bond. Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · Conversely, when a bond sells for less than par, which is known as a discount bond, its current yield and YTM are higher than the coupon rate. Only on occasions when a bond sells for its exact par ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%. The current yield on a bond is the stated coupon rate See Page 1. The current yield on a bond is the stated (coupon) rate divided by the bond price as a percentage of face value or, alternatively, the sum of the coupon payments for one year divided by the bond price. 13. A bond with a stated coupon rate of 5% that is selling at 98.54% of face value has a current yield of 5 / 98.54 = 5.074%.

Bond Yield Calculator - Compute the Current Yield - DQYDJ The current yield of a bond is the annual payout of a bond divided by its current trading price. That is, you sum up all coupon payments over one year and divide by what a bond is paying today. Bond Current Yield vs. Yield to Maturity

Current Yield Formula | Calculator (Examples with Excel Template) Current Yield = Annual Coupon Payment / Current Market Price of Bond For Bond 1 Current Yield = $70 / $920 Current Yield = 7.61% For Bond 2 Current Yield = $80 / $1000 Current Yield = 7.27% For the next one year, Bond 1 seems to be a better investment option given its relatively better current yield. Explanation

Yield to Maturity | Formula, Examples, Conclusion, Calculator Mar 24, 2021 · The bond has a price of $920 and the face value is $1000. The annual coupons are at a 10% coupon rate ($100) and there are 10 years left until the bond matures. What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%.

Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

Current Yield Calculator | Calculate Current Yield of a Bond Current Yield = Coupon Payment / Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. That's it!

Current Yield of a Bond - Meaning, Formula, How to Calculate? The reason why current yield fluctuates and deviates from the annual coupon rate is because of the changes in interest rate market dynamics Market Dynamics Market Dynamics is defined as the forces of market constituents responsible for the shift in the demand and supply curve and are therefore accountable for creating and reducing the demand ...

Of coupons, yields, rates and spreads: What does it all mean? Unlike a coupon which is static, the yield is a dynamic value that accounts for the current price of the bond. Take a bond with a face value of $100, which we'll call XYZ bond. At inception, the bond's yield is equal to its coupon, because the bond price is at par, or at 100% of the face value. So at issuance it has a 5% coupon and a 5% yield.

Current Yield - Investopedia How Current Yield Is Calculated If an investor buys a 6% coupon rate bond for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is ($60) /...

Individual - Treasury Notes: Rates & Terms Yield at Auction Interest Coupon Rate Price Explanation; Discount (price below par) 10-year Note Issue Date: 8/15/2005: 4.35%: 4.25%: 99.196069: Below par price required to equate to 4.35% yield: ... If you are a TreasuryDirect customer, you should look at your Current Holdings, Pending Transactions Detail after 5 pm Eastern Time on auction day ...

Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

What Is Current Yield? - The Balance Knowing a bond's coupon yield and current yield can help you anticipate your return on investment. Let's take a look at the math to calculate current yield. Again, if you receive $20 in annual interest on a bond with a par value of $1,000, the coupon rate is 2%.

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

What is the effective annual yield formula? The current yield is equal to the annual interest earned divided by the current price of the bond. Suppose a bond has a current price of $4,000 and a coupon of $300. Divide $300 by $4,000, which equals 0.075. Multiply 0.075 by 100 to state the current yield as 7.5 percent.

Yield to maturity - Wikipedia An ABCXYZ Company bond that matures in one year, has a 5% yearly interest rate (coupon), and has a par value of $100. To sell to a new investor the bond must be priced for a current yield of 5.56%. The annual bond coupon should increase from $5 to $5.56 but the coupon can't change as only the bond price can change.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link.

Difference Between Coupon Rate and Yield of Maturity The current yield compares the coupon rate to the market price of the bond. 4; The coupon amount remains the same till its maturity. The market price keeps on changing so it's better to purchase a bond at a discount which represents a larger share of the purchase price. 5;

Post a Comment for "45 current yield coupon rate"