45 what is a coupon payment on a bond

What Is a Coupon Rate? And How Does It Affects the Price of a Bond? The coupon rate is also called coupon payment. It is the yield the bond paid on its issue date. The yield changes when the value of the bond changes. Such a case results in giving the bond's yield to maturity. In the case of the booming market, the coupon holder yields lesser than the prevailing market conditions as bonds won't pay more. ... How to Calculate an Interest Payment on a Bond: 8 Steps 10.12.2021 · Distinguish between a bond's coupon and a bond's yield. It is important to know the difference between a bond's yield, and a bond's coupon payment in order to not get confused when calculating interest payments. Sometimes when you look at bonds, you will see both a yield and a coupon. For example, the bond's coupon may be 5%, and the bond's ...

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupons are the periodic interest payments received by bondholders from the original date of a bond issuance until the date of maturity - which is determined by the coupon rate as part of the bond issuance agreement. Coupon Payment (C): The dollar amount of the periodic interest paid to a bondholder by the issuer.

What is a coupon payment on a bond

An 8% coupon bond makes coupon payments twice a year | Chegg.com Expert Answer Transcribed image text: An 8% coupon bond makes coupon payments twice a year and is trading at a YTM of 6%. When the bond is sold, four coupon payments remain until maturity. What is the bond's full price if there are 183 days between these coupons, and 100 days have passed since the last coupon payment and the sale of the bond? How to Calculate the Price of a Bond With Semiannual Coupon … 24.04.2019 · Therefore, the example's required rate of return would be 2.5 percent per semiannual period. To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return. Bond Basics: Issue Size and Date, Maturity Value, Coupon 28.05.2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term “coupon” comes from the days when investors would ...

What is a coupon payment on a bond. Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. How to Calculate a Coupon Payment: 7 Steps (with Pictures) 02.08.2020 · To calculate a coupon payment, multiply the value of the bond by the coupon rate to find out the total annual payment. Alternatively, if your broker told you what the bond yield is, you can multiply this figure by the amount you paid for the bond to work out the annual payment. To calculate the actual coupon payment, divide the annual payment ... What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. It was also ... Zero-Coupon Bond Definition - Investopedia 11.11.2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators Coupon Rate Calculator | Bond Coupon 12.01.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you …

Coupon Bond - Definition, Terminologies, Why Invest? The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond's nominal value and the period factor. For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 5%, your annual interest payment will be $5. Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... What Are Coupon Payments? - ClydeBank Media Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the two are distinct in a few ways. When an investor or trader purchases shares of stock in a company, they are purchasing the rights to a portion of that company's profits. Coupon Payment | Definition, Formula, Calculator & Example 27.04.2019 · A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, …

Coupon Bond Formula | Examples with Excel Template The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown below. C = Annual Coupon Rate * F

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

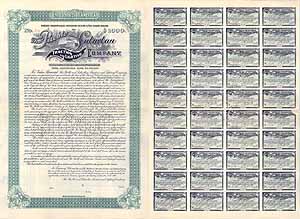

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

Russia coupon payments and default issue - RHA Ajans Coupon payment… As of yesterday, the one-month grace period for the coupon payments dated May 27 has ended and these bonds are considered to be in default.It is stated that these amounts are not transferred to the account of the lenders, since international banks do not perform dollar or other hard currency transfers and payments in rubles are not accepted, and therefore technically there is ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve …

How to Calculate a Coupon Payment: 7 Steps (with Pictures) Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies.

Post a Comment for "45 what is a coupon payment on a bond"