43 a general co bond has an 8% coupon

Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 100% (10 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the … Ch 6 HW Flashcards | Quizlet To sell a bond at its face value, the bond's coupon rate must be set equal to the yield to maturity of currently outstanding bonds. Thus, the new bond must offer a coupon rate of 7.18%. General Matter's outstanding bond issue has a coupon rate of 8.2%, and it sells at a yield to maturity of 7.25%.

Coupon Bond - investopedia.com Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means...

A general co bond has an 8% coupon

6 Coupon Rate General Matters outstanding bond issue has a coupon rate ... 11 . Bond Prices and Yields .1 . Several years ago , Castles in the Sand , Inc. , issued bonds at face value at a yield to maturity of 7 % . Now , with 8 years left until the maturity of the bonds , the company has run into hard times and the yield to maturity on the bonds has increased to 15 % . Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Bonds that are rated "B" or lower are considered "speculative grade," and they carry a higher risk of default than investment-grade bonds. Zero-Coupon Bonds. A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer only pays an amount equal to the face value of the bond at the maturity date. A company bond carries an 8% coupon, paid semiannually. The par value A company bond carries an 8% coupon, paid semiannually. The par value is $1,000, and the bond matures in 6 years. If the bond currently sells for Get more out of your subscription* Access to over 100 million course-specific study resources 24/7 help from Expert Tutors on 140+ subjects Full access to over 1 million Textbook Solutions

A general co bond has an 8% coupon. Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com Question: A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity This problem has been solved! See the answer Show transcribed image text Expert Answer YTM = 40 + (1000-1020.5)/5 … View the full answer GENERAL MOTORS CO.DL-NOTES 2017(17/27) Bond | Markets Insider The General Motors Co.-Bond has a maturity date of 10/1/2027 and offers a coupon of 4.2000%. The payment of the coupon will take place 2.0 times per biannual on the 01.04.. A General Co. bond has an 8% coupon and pays interest annually. The ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?... FIN 3000 HW 6 Flashcards | Quizlet Consider three bonds with 8% coupon rates, all making annual coupon payments and all selling at face value, which is $1000. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years.

A 12 year 5 coupon bond pays interest annually The bond has a face ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? A) 7.79% The bond sells at a premium, so its YTM has to be below 8%. A bond has a coupon rate of 8 percent, 7 years to maturity, semiannual ... A bond has a coupon rate of 8 percent, 7 years to maturity, semiannual interest payments, and a YTM of 7 percent. If interest rates suddenly rise by 2 percent, what will be the percentage change in the bond price 1 See answer Add answer + 5 pts cliftn6162 is waiting for your help. Add your answer and earn points. Answer 0 topeadeniran2 Finance Chapter 5 Flashcards | Quizlet A 12-year, 5% coupon bond pays interest annually. The bond has a face value of $1,000. What is the change in the price of this bond if the market yield rises to 6% from the current yield of 4.5%? 12.38% decrease. The Lo Sun Corporation offers a 6% bond with a current market price of $875.05. A general co bond has an 8 coupon and pays interest - Course Hero A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity.

Yield to Maturity Questions and Answers | Study.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,018.50. The bond matures in 15 years. What is the yield to maturity? View... CF Chp 8 Flashcards - Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity Current Coupon Definition - Investopedia Current Coupon: The to-be-announced (TBA) mortgage security of any issue for the current delivery month that is trading closest to, but not exceeding par value. TBA mortgage securities with the ... Buying a $1,000 Bond With a Coupon of 10% - Investopedia Most bonds pay interest semi-annually, which means bondholders receive two payments each year. So with a $1,000 face value bond that has a 10% semi-annual coupon, you would receive $50 (5% x ...

Solved A General Co. bond has an 8% coupon and pays | Chegg.com A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity? A. 7.62% B. 7.79% C. 8.24% D. 8.12% Question: A General Co. bond has an 8% coupon and pays interest semiannually.

Foundations of Finance - Class 8 and 9 - Fixed income Securities: BKM ... 10. Assume you have a 1-year investment horizon and are trying to choose among three bonds. All have the same degree of default risk and mature in 10 years. The first is a zero-coupon bond that pays $1,000 at maturity. The second has an 8% coupon rate and pays the $80 coupon once per year.

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price A General Co. bond has an 8 % coupon and pays interest annually. A zero coupon bond has a face value of $ 1,000 and matures A zero coupon bond has a face value of $ 1,000 and matures in 6 years. Investors require a (n) 6.6 % annual return on these bonds. What should be the … read more

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00% Question: A General Co. bond has an 8% coupon and pays interest annually.

Coupon Bond - Guide, Examples, How Coupon Bonds Work equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased.

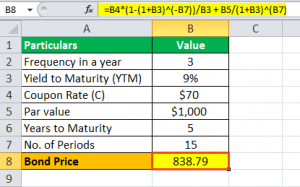

How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

Bond Coupon Interest Rate: How It Affects Price - Investopedia The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

Solved A General Co. bond has an 8 % coupon and pays | Chegg.com A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Can I Question like this be solved by Hand, e.g. by extrapolation with a Discount table OR only by Trial and error and with a financial calculator?

Coupon Bond Questions and Answers | Study.com An investor is considering buying one of two 10-year, $1,000 face value bonds; Bond A has a 7% annual coupon, while Bond B has a 9% annual coupon. Both bonds have a yield to maturity of 8%, which i...

/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "43 a general co bond has an 8% coupon"