39 how to calculate zero coupon bond price

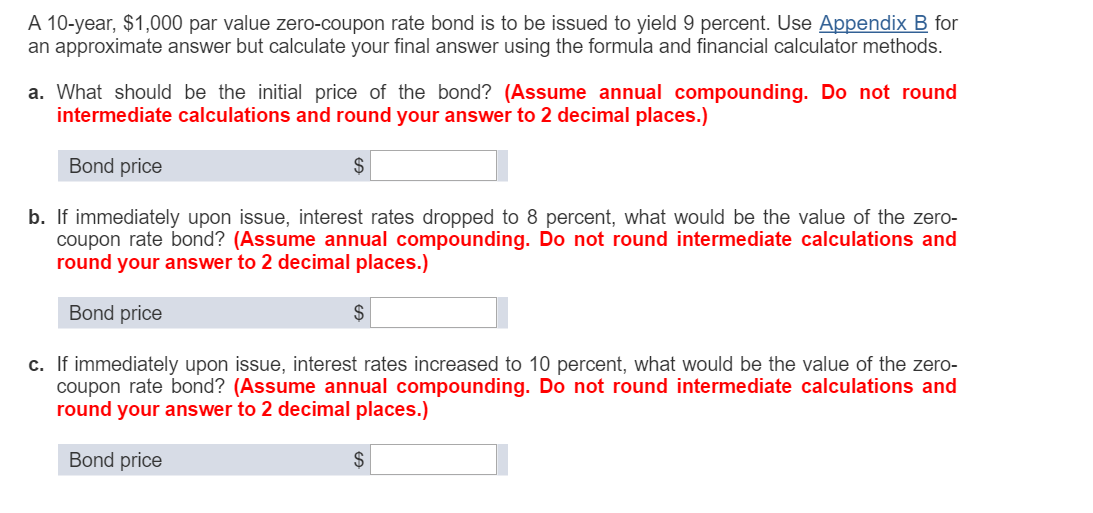

Learn to Calculate Yield to Maturity in MS Excel Given this scenario, the market will adjust the price of the bond proportionally, in order to reflect this difference in rates. In this case, the bond would trade at a premium amount of $111.61 ... How to Calculate Yield to Call (YTC): Definition, Formula ... A firm's bonds have a maturity of 8 years with a $1,000 face value, have an 11% semiannual coupon, are callable in 4 years at $1,150, and currently sell at a price of $1,275.86.

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

How to calculate zero coupon bond price

Calculating Yield to Maturity in Excel - Speck & Company There are two formulas to calculate yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [ (Face Value / Current Value) (1 / time periods)] -1. The yield to maturity formula for a coupon bond: Bond Price = [ Coupon x (1 - (1 / (1 + YTM) n) / YTM) ] + [ Face Value x (1 / (1 + YTM) n ... How to Calculate a Zero Coupon Bond Price | Double Entry ... 16/07/2019 · The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Calculate Bond Price - 7, finding yield to maturity using ... Calculate Bond Price - 15 images - pricing debt instruments, explanation bond issue price, bond formula step by step calculation of bond value with, differentiate between yield to maturity ytm and yield to, ... Zero-Coupon Bond Price. Bond Present Value Formula. Computing Bond Present Value ... Can You Pre Order Nba 2k21 Valentines Day Meme ...

How to calculate zero coupon bond price. What Are Bonds and How Do They Work? Examples ... - TheStreet Zero-coupon bonds are perhaps the simplest of bonds. A zero-coupon bond does not pay a coupon rate; instead, income is generated by issuing the bond at a discounted price compared to its face value. Quant Bonds - Between Coupon Dates - BetterSolutions.com The buyer compensates you for this by adding the accrued interest to the current price. This is the amount of the coupon payment that the holder of the bond has earned since the last coupon payment. SS - equation. Include only one of the two bracketing dates. If this is the first coupon, use the dates date instead of the previous coupon date. How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... bond-pricing - PyPI This mode is particularly convenient to price par bonds or price other bonds on issue date or coupon dates. For example, finding the price of a 7 year 3.5% coupon bond if the prevailing yield is 3.65% is easier in this mode as the maturity is simply given as 7.0 instead of providing a maturity date and specifying today's date.

How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Coupon Bond Formula | How to Calculate the Price of Coupon ... The formula for coupon bond calculation can be done by using the following steps: Firstly, determine the par value of the bond issuance, and it is denoted by P. Next, determine the periodic coupon payment based on the coupon rate of the bond based, the frequency of the coupon payment, and the par value of the bond. Zero-Coupon Bond: Formula and Excel Calculator If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula. Price of Bond (PV) = FV / (1 + r) ^ t; Where: PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero Coupon Bond Value Calculator: Calculate Price, Yield ...

Zero Coupon Bond Calculator – What is the Market Price ... To calculate the price of a zero coupon bond, we could use ... To calculate the price of a zero coupon bond, we could use the general formula for the _____ of a. To calculate the price of a zero coupon bond, we could use the general formula for the _____ of a _____. Categories Uncategorized. Leave a Reply Cancel reply. Your email address will not be published. ... How to Calculate PV of a Different Bond Type With Excel The bond provides coupons annually and pays a coupon amount of 0.025 x 1000 ÷ 2= $25 ÷ 2 = $12.50. The semiannual coupon rate is 1.25% (= 2.5% ÷ 2). Notice here in the Function Arguments Box that... What Is Dirty Price? A zero-coupon bond is a bond that doesn't pay a coupon. Instead, it trades at a deep discount and pays investors a lump sum when the bond reaches maturity. Because there's no interest accruing for a zero-coupon bond, the clean price and dirty price are the same.

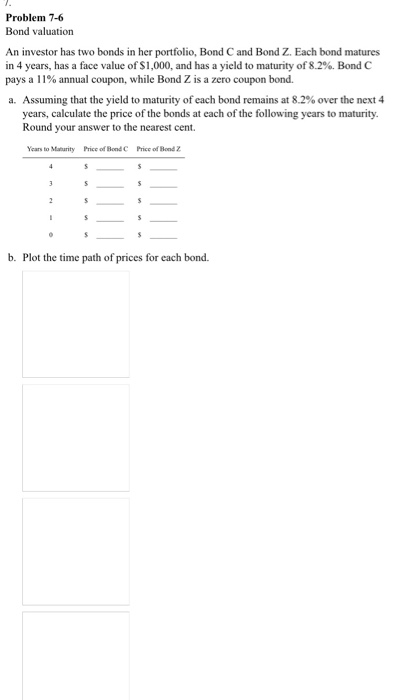

Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

ZeroCouponBond: Zero-Coupon bond pricing in RQuantLib: R ... The ZeroCouponBond function evaluates a zero-coupon plainly using discount curve. More specificly, the calculation is done by DiscountingBondEngine from QuantLib. The NPV, clean price, dirty price, accrued interest, yield and cash flows of the bond is returned. For more detail, see the source code in the QuantLib file test-suite/bond.cpp. The ZeroPriceYield function evaluates a zero-coupon ...

Yield of a Coupon Bond calculation using Excel. How to ... In this article, we're going to talk about how to calculate the yield of maturity for a coupon bond. For a coupon bond, we're talking about a bond that's going to pay periodic interest payments. So it's different from a zero-coupon bond where you just pay a price and then you get the face value back later and it's for a larger amount than it ...

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...](https://www.finpricing.com/images/zero-coupon-bond-valuation-FinPricing.jpg)

[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...

Price of a Zero coupon bond - Calculator - Finance pointers August 20, 2021. August 20, 2021. | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face ...

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

fixed income - How to calculate zero-coupon curve for ... The "z" in "z-spread" stands for "zero volatility", not "zero curve". If you're trying to calculate a "Z-spread" similar to Bloomberg's, then you can calculate (numerically) how much the EUR swap curve needs to be shifted in parallel in order for the bond cash flows discounted with the shifted swap curve to match the bond price.

Understanding Zero Coupon Bonds - Part One Here is an example of how zero coupon bond prices can change: For example, assume that three STRIPS are quoted in the market at a yield of 6.50%. The price for STRIPS with 25 years remaining to maturity would be $202.07 per $1,000 face amount

Post a Comment for "39 how to calculate zero coupon bond price"